Imagine you are a trader who has spent years mastering your craft and finally become profitable. Well, you might actually be one. Moreover, the odds are that you are not very wealthy and have limited capital to trade and make a significant amount of money that is worth your time. In this case, you are definitely searching for ways to acquire more assets under management (AUM). In this article, we’ll talk about prop firms, which are one of the most popular ways to get more funding these days.

I’ll begin this Traders Fund Hub article by introducing what a prop firm is and how it works. I will also address some misconceptions about prop firms and why they are not really proprietary trading firms. Then, we will discuss how prop trading firms work and why you should consider them as one of the primary sources of funding for a retail trailer. And don’t worry; you are going to read the insights of a real trader who has actually been funded by multiple firms in his career.

- Prop firms give traders access to capital after passing evaluations, while traditional proprietary firms hire traders to manage company funds directly.

- To get funded, traders must complete challenge phases that include meeting profit targets and staying within risk parameters.

- The main financial risk for traders is the non-refundable challenge fee they pay upfront.

- Prop firms primarily earn revenue from evaluation fees — and while manipulation exists, many legit firms offer fair conditions.

- Prop trading is best suited for day traders, those without verified track records, and intermediate traders seeking rapid capital growth.

What Is a Prop Firm?

You’ve definitely heard of prop firms like FTMO, FundedNext, FXIFY, The Funded Trader, City Traders Imperium, or Funding Pips already. In fact, they’ve become very popular within the retail trading space since COVID. These firms are companies that offer consistently profitable traders additional capital to trade on and compensate them with a share of potential profits. Yet, with a little bit of research, you’ll probably know this is not entirely true. But, more on that later.

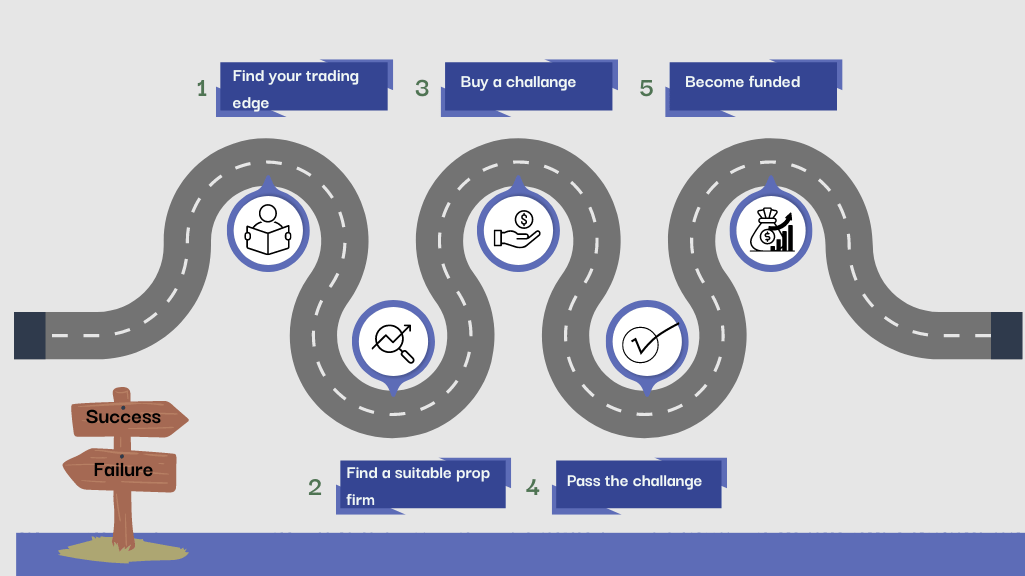

Now, you might be asking, how do prop trading firms evaluate traders? Most firms offer evaluation programs that are known as challenges. To get funded, you should first pass prop firm challenges. And, of course, to participate in these challenges, you should pay a cost. Obviously, if you fail the challenge, your money is gone. So, the challenge price will be the only risk you take while trading with these firms. There are also some firms with no evaluation that allows you start right away! You can read about them more on our artilce about the best instant funding prop firms.

Prop Firms vs Proprietary Trading Firms

In traditional finance, the terms “prop firm” and “proprietary trading firm” are often used interchangeably. However, during the last decade, these two terms have become completely different in the retail trading industry.

Proprietary trading firms are companies that trade financial instruments such as stocks, bonds, or currencies using their own capital. This is the opposite of institutions like hedge funds and private equities, which manage investor capital. So, the goal of a proprietary trading firm is to generate profits for themselves. These firms usually hire professional traders to trade on their capital and offer them fixed salaries and sometimes a share of profits.

On the other hand, prop trading firms (also known as funding firms) are quite different. These companies mostly operate online. You almost never meet a prop firm employee in person as a funded trader. This is because prop trading firms don’t hire you. They only evaluate your performance via web trading means and offer you capital to trade on (you’ll work like a freelancer). Moreover, unlike traditional proprietary trading firms, anyone, even without a valid track record, can participate in prop firm challenges and become funded. There are various prop firms out there, and at Traders Fund Hub, you will find complete reviews of different firms like E8 Markets, Bright Funded, or OFP Funding, each with their unique evaluation models.

Read More: Are prop firms legal in the US?

How Do Prop Firms Really Work?

Until this point, we’ve talked about prop firms and what they are. Yet, there is much more detail we still need to cover to get a better understanding. I’ll walk you through a hypothetical situation to clearly explain what really goes on from the beginning.

Prop Firm Challenge Phase

Imagine you’ve done your homework and are finally a profitable trader with a proven edge. Now, you’re going to try getting funded by a prop trading firm. The first step is to choose a challenge type and account size. Let’s break it down:

- Challenge Type: Different firms have various challenge types. The differences between these challenges are primarily in their trading conditions and number of phases.

- Account Size: As the name gives it away, the account size will be the amount of capital you’ll have in both your evaluation and funded account (if you pass).

Both of these factors are crucial and will affect the price of the challenge you’ll buy.

Now, imagine you’ve selected a standard 2-step prop firm challenge for a $100K account and have paid $500 for it. If you pass the challenge, most firms will refund your $500 with your first payout. On the other hand, if you fail, you can forget about the money you paid.

So, if you are sure of your trading edge and, in some cases, have as little as $60 (which you can buy a $10K challenge with on some firms), you can buy a challenge and begin your prop trading journey.

Let’s dive deeper into the challenge. Consider these imaginary conditions for your challenge and account type:

- Challenge Price: $500

- Profit target: 10% ($10K) for step 1 and 5% for step 2

- Drawdown limit: 10% ($10K)

- Daily drawdown limit: 5% ($5K)

- Minimum trading days: 5

- Maximum trading days: Unlimited

- Payout period: 4 weeks

- Payout ratio: 80%

I’ll now explain all these details in plain English. Starting from the top, the profit target is the goal you have to hit on your challenge account. In the first phase, you’ll have to realize 10% profits to move on to the second, and 5% in the second phase to become funded.

Of course, you should reach the profit targets without violating other rules, such as losing more than 10% of the account or 5% in a day. You’ll also have to trade for a minimum of 5 days in order to get to the next phase in each step. Remember, while there is no time limit in this imaginary prop firm challenge, some challenge types and prop trading firms offer limited-time challenges. So, if you prefer to go without a limit, choose your firm and challenge type carefully.

Read More: Are Prop Firm Passing Services Worth the Risk?

Prop Firm Funded Phase

So, in this scenario, you’ve successfully passed your challenge. After going through the KYC process and signing the funding contract, you will get your funded account. Now, there will not be a profit target, time limit, or even minimum trading days (of course, you should trade once in a while to prove you’re active).

Meanwhile, the same drawdown rules, both overall and daily, apply to your funded account. So, you cannot lose more than 5% on a day and 10% overall, or you’ll lose your funded prop firm account. Note that the calculations might be based on either balance-based or equity-based drawdown rules. There are also some additional rules that might apply to the funded phase, like the consistency rule. Yet, these rules might vary among firms. So, we will not discuss it in this article.

Now, imagine you’ve stuck to your trading plan and have been profitable on the funded account. After 4 weeks, you can request a payout, which is essentially a withdrawal of profits made on the account. For example, let’s say you’ve made 5% ($5K), which means your account has a balance of $105K after four weeks. You are eligible to request a payout of all these profits. Yet, you will only receive 80% (profit share ratio) of them, which is $4,000,

Following the payout, your account will be reset to $100K, and you can continue trading. This process can be repeated every four weeks (in this imaginary case), and you can earn 80% of the profits you make on the funded account as long as you remain funded. and here’s some good news: If you’re interested in futures trading but don’t know where to start, our blog which introduces the best futures prop firms in 2025, is sure to help you.

Are Prop Firms Legit?

There have been a lot of controversies going on around prop firm trading over the past couple of years. Many traders and influencers have pointed out some shady businesses by prop trading firms, including how they make their traders fail. In fact, considering their business model, these assumptions might not be far from the truth, at least for most firms.

One common misconception that has been clarified after the My Forex Funds crackdown is the fact that prop firms do not provide real accounts to their funded traders. Therefore, when you earn a certain amount on your funded account, you are getting paid for demo trading. This means that the 20% share of profits that the firm keeps is essentially a lie, as your profits are not real. Most prop firms pay you from their own capital.

Now, imagine you are the owner of one such firm. Would you like your traders to crush the markets and make tons of money? Likely not. This is because you should pay them and you’ll earn nothing. So, what’s the prop firm business model based on? The answer is challenge fees.

The primary revenue of any prop trading firm, including the legit, reliable ones that provide real accounts to top traders, comes from losing traders who buy challenges and fail. As a result, many prop firms will use strict rules, high spreads, and slippage to make you fail. Yet, there are always traders who are able to play by these rules and win, and most prop trading firms will pay you out if you don’t violate any rule. So, while many scammers are operating in this space, the best prop firms are legit.

Who Should Go for Prop Firm Funding?

Now that you know the most important things about these firms, let’s analyze who should go for prop firm funding. I’ve prepared the list below, and if you fall into each of these categories, prop trading firms might be the best funding solution for you:

- Scalpers and Day Traders: Profitable scalpers and day traders can always pass prop firm challenges with ease and keep their accounts. With many firms imposing restrictions on overnight holding of positions, prop trading firms might not be suitable for swing traders.

- Traders Lacking Verified Track Record: A lot of traders fall into this group, as anyone can become a trader nowadays, thanks to the internet and technology. Traders who lack a verifiable trading record are not likely to acquire investor funding, and prop firm trading can be their savior.

- Intermediate Traders: While prop firms are not suitable for beginners, as they mostly become a revenue source for the firms (as we discussed earlier), intermediate traders who do not like or cannot approach individual investors can benefit massively from these firms.

- Individual Traders: Most prop firm traders are individuals rather than teams. This is because even maximum funding by all top firms cannot satisfy a team of professional traders and asset managers.

- Impatient Traders: While patience is a holy skill in trading, impatience exists in human nature, and you can’t deny it. If you are looking for quick access to more AUM, prop firms are arguably the best way to go.

Conclusion

In this article, we’ve analyzed what prop firms are, how they work, and whether they’re legit or not. I also provided a list of traders for whom prop firm trading is the best. So, with this comprehensive guide, you now have the necessary knowledge to decide whether you want to go after prop funding or not.

Yet, remember, while prop trading firms are a great way to access more AUM, a large portion of these companies are scams. While this is a topic for another article, make sure to use the best and most credible prop firms, even if there is that new firm that offers the cheapest challenges with the best conditions. In the trading space, a lot of things are too good to be true.

At Traders Fund Hub, we provide you with the necessary information to help you choose the best funding method possible for you. We also strive to provide you with the latest developments in the trading industry so you’re always informed.

So, if you seek the latest prop firm reviews, copy trading platform reviews, and news related to these funding methods and the trading space in general, subscribe to our newsletter. You won’t regret it.