Bright Funded Overview

| Founded | 2023 |

| Headquarters | Dubai, UAE |

| Evaluation Models | 2-Step Evaluation |

| Max Allocation | $400K (Up to $2 million with scaling) |

| Trading Platforms | cTrader, DX-Trade |

| Assets | Forex, Commodities, Indices, Crypto |

The Bright Funded prop firm was launched in 2023 and is based in Dubai, UAE. It offers funded accounts from $5K to $200K, with fun names like Pluto, Neptune, and Jupiter! You get access to a wide range of markets, including forex, indices, commodities, and cryptocurrencies.

The idea behind Bright Funded is simple: to give skilled traders a real chance to grow, without using their own money. With a strong focus on transparency, fairness, and supporting traders, Bright Funded isn’t just a challenge; it feels like a journey through space!

In this Bright Funded review, you’ll find out everything you need to know about this prop firm. For more prop firm reviews, check out the best prop firms in the UK.

- Founded in 2023, Bright Funded is a Netherlands-based prop firm offering funded accounts from $5K to $200K.

- Traders go through a 2-step evaluation model with no time limit, 5 minimum trading days, 5% daily and 10% total drawdown, and reasonable profit targets (8% and 5%).

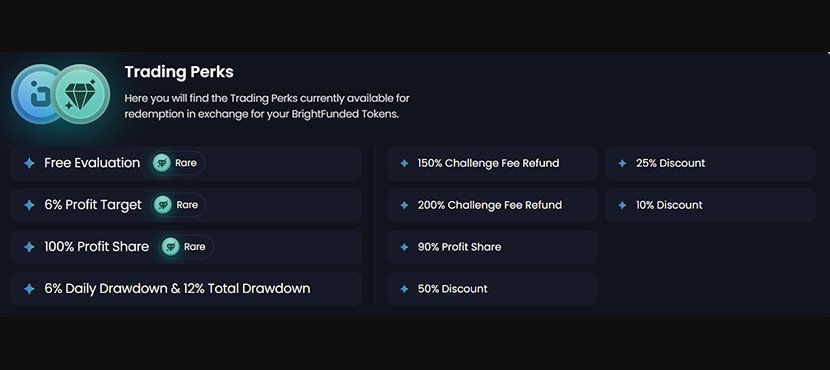

- Unique BrightFunded Tokens (BFTs) reward traders for activity regardless of success—usable for perks like free challenges or increased payout percentages.

- Trading platforms include cTrader and DX-Trade, giving access to both Forex/CFDs and crypto markets.

- Assets offered include Forex, commodities, indices, and cryptocurrencies with competitive leverage (up to 1:100 for Forex).

- Scaling plan boosts account size by 30% after 4 months if consistency and profit conditions are met.

- Trade2Earn loyalty program incentivizes trading activity with practical benefits like lower profit targets and higher drawdowns.

- Payout options: Default (30-day + bi-weekly), Bi-weekly with 15% fee, or Weekly with 25% fee.

- Flexible rules: Hedging, EAs, and self-copy trading are allowed; no news restrictions during evaluation phases.

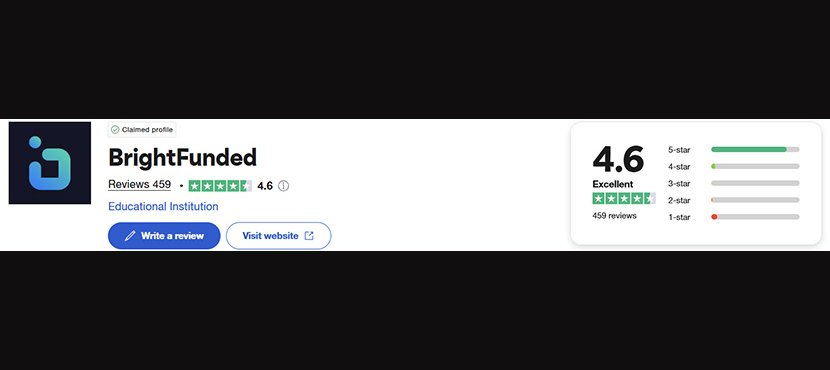

- Highly rated on Trustpilot with a 4.6/5 score from over 460 reviews, showing positive sentiment overall.

Bright Funded Prop Firm Review: Evaluation Phases

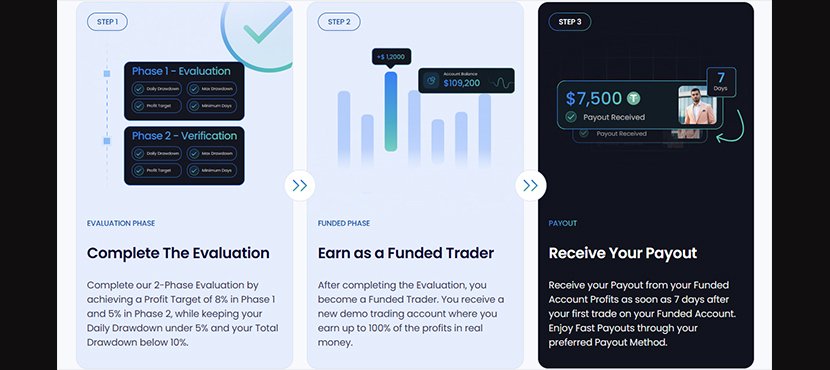

If you want to trade with Bright Funded prop firm, you’ll need to complete their challenge first. It’s a two-step evaluation process that’s pretty straightforward and comes with fair rules. Once you pass both phases, you’ll officially become a Bright Funded trader. You can read more about the rules in this Bright Funded review below.

Evaluation Phase 1

During Phase 1 of the Bright Funded challenge, you need to pass the challenge while also earning BrightFunded Tokens (BTFs) based on your trading volume, as a result of your trading activities.

Here’s what you need to know about the rules for this phase:

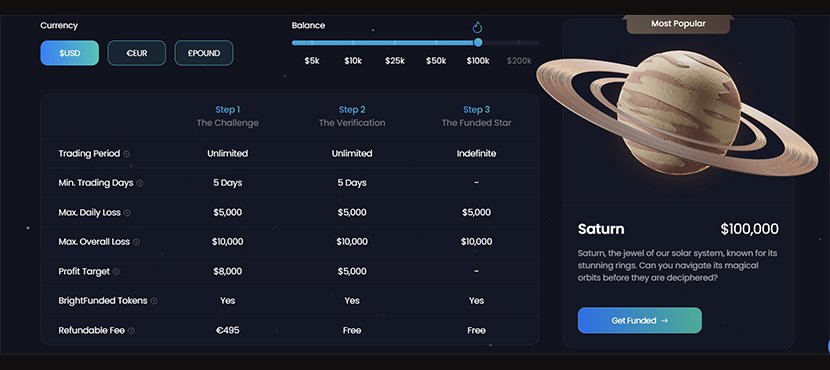

- Trading Period: Good news: there’s no time limit for passing the challenge! You can take your time reaching your goals without the pressure of a countdown!

- Minimum Trading Days: This is simply the minimum number of days you need to actively trade before completing the phase. This is set to 5 trading days, meaning that you need to trade at least 5 days before finishing this phase.

- Max Daily Loss: Bright Funded is a balance-based drawdown prop firm. This means that the drawdown on this phase is based on your initial balance and is set to 5%. If that sounds a bit unfamiliar, don’t worry! We’ve got a helpful article comparing balance-based and equity-based drawdowns. It’s definitely worth a read!

- Max Overall Loss: This is the total loss from your initial balance. The limit here is 10%.

- Profit Target: You’ll need to hit a profit target of 8% to pass this challenge. For example, if you start with $100,000, your goal will be $8,000 in profit.

- BrightFunded Tokens (BTFs): These are your rewards for trading, and yes, you get them whether you pass or not! You can use BTFs to unlock special perks like boosted payouts or even get free evaluation attempts.

Evaluation Phase 2 (Verification)

Once you pass Phase 1, you’ll move on to Phase 2; think of it as a verification step. The idea of this verification comes from the consistency rule in prop firms. The goal here is to check that your trading performance stays consistent. The good news? The rules in this phase are a bit more flexible:

- Trading Period: No time limit

- Minimum Trading Days: 5

- Max Daily Loss: 5%

- Max Total Loss: 10%

- Profit Target: 5%

- BrightFunded Tokens: Included

Bright Funded Prop Firm Funded Accounts

Once you’ve passed both evaluation phases at Bright Funded prop firm, you’ll officially become a Bright Funded trader!

Your funded account will be based on the initial balance you initially picked. Each account type has its own name and price, which are listed below:

| Account Balance | 5K | 10K | 25K | 50K | 100K | 200K |

|---|---|---|---|---|---|---|

| Account Name | Pluto | Mars | Venus | Neptune | Saturn | Jupiter |

| Price | €55 | €95 | €195 | €295 | €495 | €975 |

Bright Funded Prop Firm: Payout Cycles

While working on this Bright Funded review, I found out there are actually three different payout cycles you can choose from:

- Default: This is the standard option. Your first payout comes 30 days after your first trade. After that, payouts switch to every 14 days.

- Bi-Weekly Payouts: You’ll be paid every 14 days, but this option has a 15% fee.

- Weekly Payouts: If you prefer faster access to your profits, you can choose weekly payouts, with a 25% fee.

Bright Funded Rules Overview

When trading with prop firms, whether it’s Bright Funded, FTMO, Funding Pips, OFP Funding, Alpha Capital Group or any other, there are certain rules you need to follow if you want to keep your account and continue trading. Below are the key rules you’ll need to stick to when trading with Bright Funded prop firm:

News Trading

If you’re in Phase 1 or 2 of your Bright Funded challenge, you’re free to trade around news events; no restrictions. So feel free to use any news-based strategies you like.

However, once you move on to a Funded Star Account, there’s one important rule: don’t open any trades within 5 minutes before or after major news releases.

If you do and the trade is profitable, you will lose the profit. If it ends in a loss, the loss stays. This is called a soft breach; your account won’t be closed, but it’s still a rule you should stick to.

EA Trading

Using Expert Advisors (EAs) is allowed at Bright Funded prop firm. Whether you’re running your own robot or using a third-party EA, that’s totally fine. Just remember: the usual rules still apply, like your daily and total loss limits. Also, if you’re using a popular EA, others might be using it too, meaning you won’t be the only one with that strategy. It’s a good idea to check in on your EA regularly to ensure it’s working as you expect and not putting your account at risk. Interested in prop firms that support EA trading? Don’t miss our 2025 Topstep review!

Copy Trading

You’re allowed to copy trades, but only between your own accounts. That includes your Bright Funded account, accounts with other prop firms, or even your retail broker accounts, as long as they all belong to you. However, copying trades from someone else’s account, even a friend or family member, is not allowed. The same goes for using signal trading or trading based on someone else’s account. Bright Funded watches for accounts with similar trade patterns, and if yours is flagged, it could lead to profit loss, account reset, or even a ban. The goal here is to keep things fair and make sure everyone is trading independently. You can read more about this concept and see how it works in our article about copy trading. Already familiar with copy trading but looking for a reliable platform? Our “ZuluTrade Review” might be just what you need!

Hedging

Hedging, opening buy and sell trades on the same instrument, is allowed, but only within the same trading account. So if you want to hedge, do it in one account, not across multiple accounts or platforms. Hedging between different prop firms or using different platforms connected to Bright Funded firm isn’t allowed.

Bright Funded Trading Platform

When trading with Bright Funded, you can choose between two platforms: cTrader and DX-Trade. Here’s a quick Bright Funded review of both platforms:

| Feature | cTrader | DX-Trade |

|---|---|---|

| Platform Type | Forex & CFD trading platform | Cryptocurrency exchange platform |

| Main Focus | Forex, indices, commodities, and CFDs trading | Crypto trading |

| Interface | Advanced, professional, clean layout | Simple, modern interface for crypto trading |

| Copy Trading | Available | Not available |

| Availability | Mobile and Web | Mobile and Web |

| Backtesting | Available | Not available |

Bright Funded Prop Firm Scaling Plan

As they say, the sky is the limit! Bright Funded prop firm believes that there are no limits to what you can achieve. With the Bright Funded scaling plan, you can go as far as your skills and efforts take you. Based on this scaling plan, your funded star account will be increased by 30% of the original account size if you follow the terms below:

- 4-Month Check: Bright Funded prop firm checks out your account over 4 months to see how you’re doing.

- Profit: You need to make a profit in at least two of those four months, and your total profit should be at least 10%.

- Payouts: You should complete at least two payout requests from your Funded Star account.

- Account Balance: When it’s time to scale up, your account balance should be at break-even or in profit.

Bright Funded Prop Firm Trade2Earn Feature

Besides the evaluation models, pricing, and scaling plan I’ve already talked about in this Bright Funded review, there’s one more feature I found really exciting, and I think you’ll want to hear about it too. It’s called Trade2Earn, and it’s kind of like a loyalty program for traders. What makes it special is that it doesn’t just reward you for being profitable, it also gives you credit for your overall trading activity. Here’s how it works:

With the Trade2Earn feature, Bright Funded gives out BrightFunded Tokens (BFTs) based on your trading volume, whether your trades are wins or losses. It applies to both evaluation accounts and funded accounts, so you can start earning from day one.

And here is what you can do with those BFTs:

- Increased Drawdown Limits: Allowing for more flexibility in trading strategies.

- Lower Profit Targets: Making it easier to pass evaluation phases.

- Free or Discounted Evaluation Challenges: Reducing the cost of accessing funded accounts.

- Enhanced Profit Splits: Potentially increasing your share of trading profits.

Bright Funded Trust Pilot: Ranks and Comments

When you’re searching for a trustworthy and reliable prop firm, most traders focus on things like evaluation models and trading rules, and that makes sense. But there’s another factor that’s just as important: what other traders are saying. Think about it! Imagine a firm with easy evaluations and great pricing, but high fees and a support team that barely responds. Would it really be worth it? Probably not. That’s why I took some time to check out what people are saying about Bright Funded on platforms like Trustpilot. Here’s what I found:

Bright Funded has around 460 reviews, and most of them are 5 stars, giving the firm an overall rating of 4.6 out of 5. Of course, no company is perfect. I did come across a few negative reviews, mostly related to their payout structure. So it’s good to be aware of both the pros and cons.

Bright Funded Prop Firm Assets and Leverage

With Bright Funded prop firm, you can trade a wide range of assets, including forex, cryptocurrencies, indices, and commodities, all with competitive leverage options. Here’s a quick breakdown of the available leverage:

- Forex (FX): 1:100

- Gold & Commodities: 1:40

- Indices: 1:20

- Crypto: 1:5

Conclusion

Well, in this Bright Funded review, I covered all the details you should know about this prop firm.

To start with, the evaluation models are simple with account balances from $5K up to $ 200 K. Once you pass both the evaluation and verification phases, you’ll officially become a funded trader, which means you’ll be able to earn real profits.

But that’s not all. Bright Funded prop firm also offers some extra features to help you boost your earnings, like a scaling plan and the Trade2Earn option. These can really make a difference if you’re consistent with your trading.

Above all, keep in mind that this prop firm is still new, and before getting started, it’s a good idea to also check out other traders’ reviews and experiences to see if it’s the right fit for you. You can also check our other reviews on different prop firms at Traders Fund Hub. Thank you for reading, and wishing you green pips!